Digital Business Hub

Are you a West Bronx business owner in need of help? You’ve come to the right place. In collaboration with various partner organizations, the Jerome Avenue Revitalization Collaborative (JARC) can help your business apply for grants and loans, access free legal assistance, develop a marketing or public relations strategy, and so much more.

To get started, join our WhatsApp group or click on one of the buttons below to complete a brief intake form!

For a full list of our services, click here.

I’m a West Bronx business owner who needs help…

Video Gallery

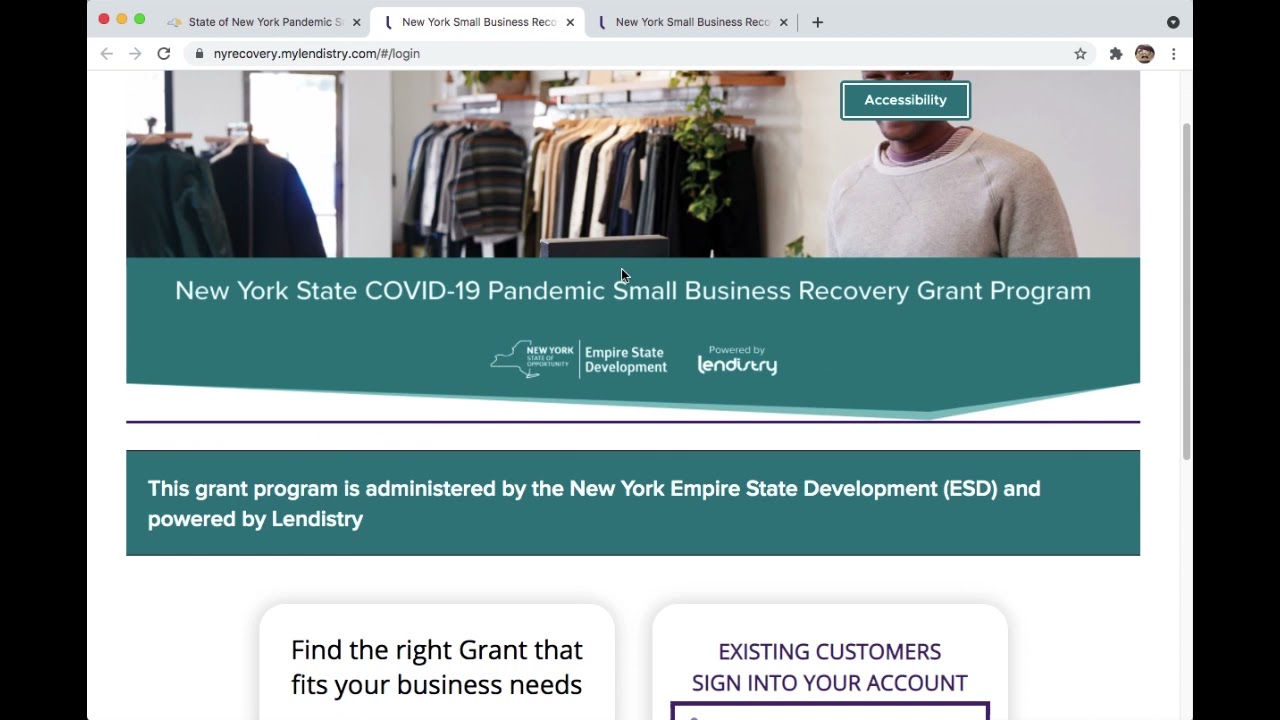

Small Business Grant from New York State. Apply starting on June 10, 2021 (Updated: 06/10/2021)

For more information about this grant, visit https://nysmallbusinessrecovery.com/ or call 347-973-0945

—- DOCUMENTATION REQUIRED —-

– Government Issued Photo ID/ITIN CP565

– 2019 and 2020 Business Income Tax returns

— Corporations & LLCs: IRS Form 1120

— Partnerships: IRS Form 1065 and Schedule K-1

— Sole proprietors: IRS Form 1040 Schedule C

ADDITIONAL DOCUMENTATION IF APPROVED FOR A GRANT

– Completed IRS Form 4506-C

– Proof of number of employees (NYS-45)

– One of the Following: Articles of Incorporation, Certificate of Organization, Fictitious Name of Registration, Government-Issued Business License

– Two proofs of business location, including:

— Current lease or mortgage statement

— Utility bill

— Business bank statement

— Credit card statement

— Professional insurance bill

— Payment processing statement

— NYS ST-809 or ST-100 sales tax collection documentation.

– Schedule of owners, including Photo ID, names, addresses, Social Security Numbers, phone numbers, e-mails, and percentage ownership.[+] Show More

For more information about this grant, visit https://nysmallbusinessrecovery.com/ or call 347-973-0945

—- DOCUMENTATION REQUIRED —-

– Government Issued Photo ID/ITIN CP565

– 2019 and 2020 Business Income Tax returns

— Corporations & LLCs: IRS Form 1120

— Partnerships: IRS Form 1065 and Schedule K-1

— Sole proprietors: IRS Form 1040 Schedule C

ADDITIONAL DOCUMENTATION IF APPROVED FOR A GRANT

– Completed IRS Form 4506-C

– Proof of number of employees (NYS-45)

– One of the Following: Articles of Incorporation, Certificate of Organization, Fictitious Name of Registration, Government-Issued Business License

– Two proofs of business location, including:

— Current lease or mortgage statement

— Utility bill

— Business bank statement

— Credit card statement

— Professional insurance bill

— Payment processing statement

— NYS ST-809 or ST-100 sales tax collection documentation.

– Schedule of owners, including Photo ID, names, addresses, Social Security Numbers, phone numbers, e-mails, and percentage ownership.[+] Show More

01:27 Eligibility

06:04 What do you need to apply

09:56 Where to apply

32:24 Uploading documents

Update: Governor Kathy Hochul on Aug 25th announced changes to New York State’s $800 million COVID-19 Pandemic Small Business Recovery Grant Program that will enable more small businesses to apply for funding. Starting today, businesses with revenues up to $2.5 million can apply for grants, up from the previous threshold of $500,000. Additionally, the limitation for businesses that received PPP loans has been increased from $100,000 to $250,000.

More information is available by visiting the Empire State Development page at https://esd.ny.gov/ and searching “NYS COVID-19 Pandemic Small Business Recovery Grant.” From there, you will find the link to the application portal at: https://nysmallbusinessrecovery.com/

*This program is only open to small businesses registered in New York State that were open before March 1, 2019 and are operating on the date that you fill out the application. Please read the full eligibility on nysmallbusinessrecovery.com before you apply.*

WHEDco is a non-profit in the Bronx and an official NYS Technical Assistance provider. For help with your application, call/text 347-973-0945

—- DOCUMENTATION REQUIRED TO APPLY —-

– Government Issued Photo ID/ITIN CP565

– 2019 and 2020 Business Income Tax returns

— Corporations & LLCs: IRS Form 1120

— Partnerships: IRS Form 1065 and Schedule K-1

— Sole proprietors: IRS Form 1040 Schedule C

– Application Certification (from https://nysmallbusinessrecovery.com/)

ADDITIONAL DOCUMENTATION IF APPROVED FOR A GRANT

– Completed IRS Form 4506-C

– Proof of number of employees (NYS-45)

– One of the Following: Articles of Incorporation, Certificate of Organization, Fictitious Name of Registration, Government-Issued Business License

– Two proofs of business location, including:

— Current lease or mortgage statement

— Utility bill

— Business bank statement

— Credit card statement

— Professional insurance bill

— Payment processing statement

— NYS ST-809 or ST-100 sales tax collection documentation.

– Schedule of owners, including Photo ID, names, addresses, Social Security Numbers, phone numbers, e-mails, and percentage ownership.[+] Show More

For help with your application call 917-943-9661[+] Show More

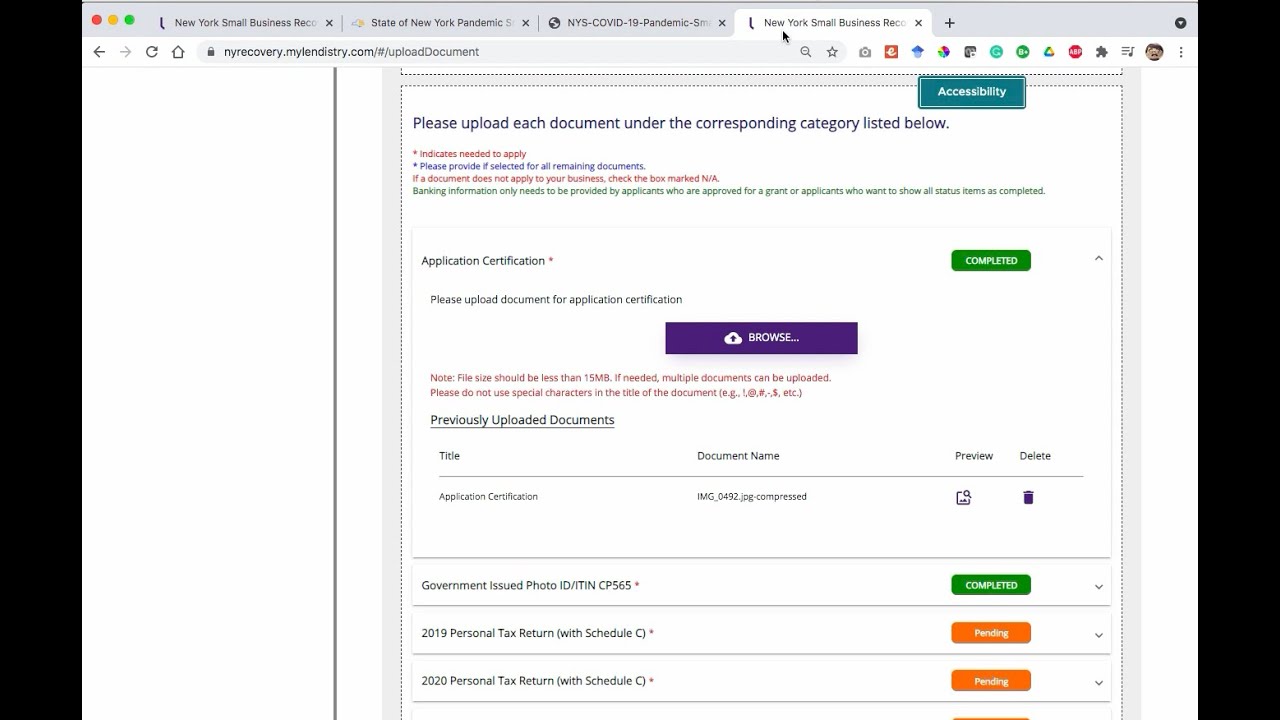

00:45 Eligibility

05:05 Required Documents

06:53 How to apply

17:13 Uploading documents

*This program is only open to NYC small businesses registered in New York State that were open before Oct 1, 2019 and are operating on the date that you fill out the application. Please read the full eligibility on https://covidresilience.nyc/ before you apply.*

WHEDco is a non-profit in the Bronx and an official NYS Technical Assistance provider. If you are a Bronx business owner and need help with your application, call/text 347-973-0945.

—- DOCUMENTATION REQUIRED TO APPLY —-

– Application Certification (from https://covidresilience.nyc/)

– Government Issued Photo ID

– 2019 Business Income Tax returns

– Proof of loss of sales, gross receipts or revenue comparing same period in 2020 to 2019

— quarterly (P&L Statements or quarterly taxes

— annually (2020 Business Income Tax, etc)

– Signed W-9 form[+] Show More

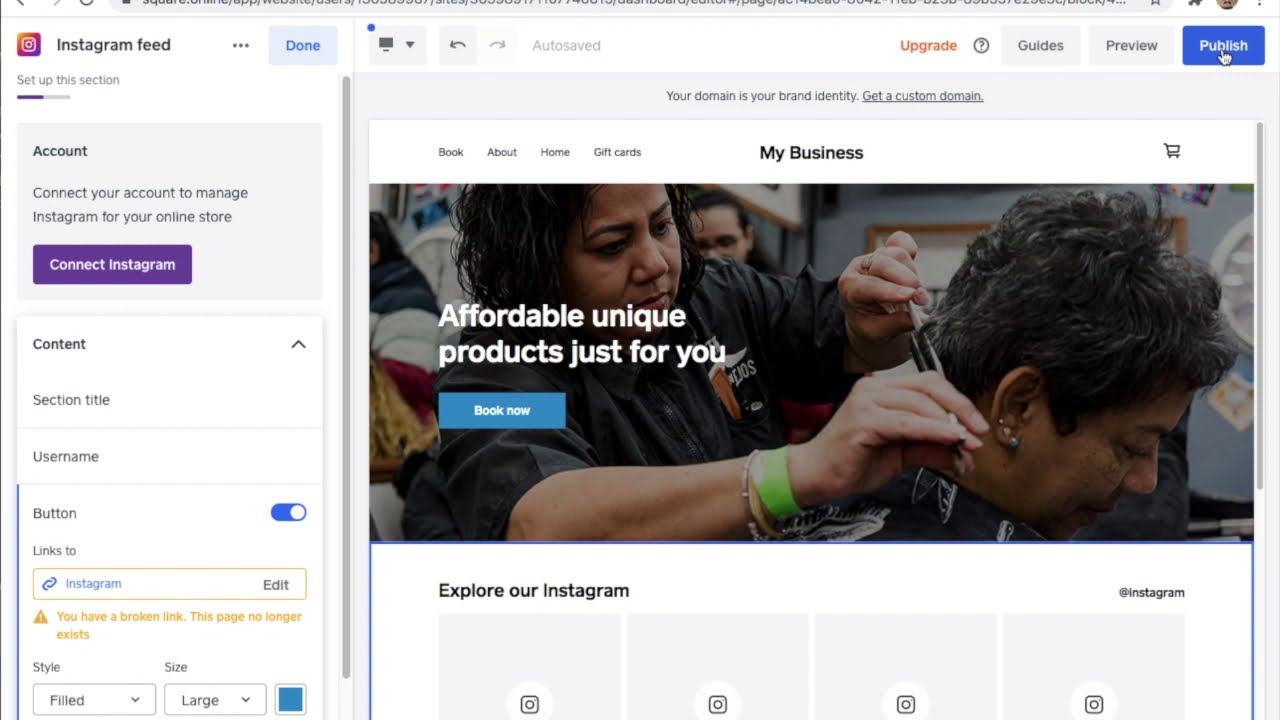

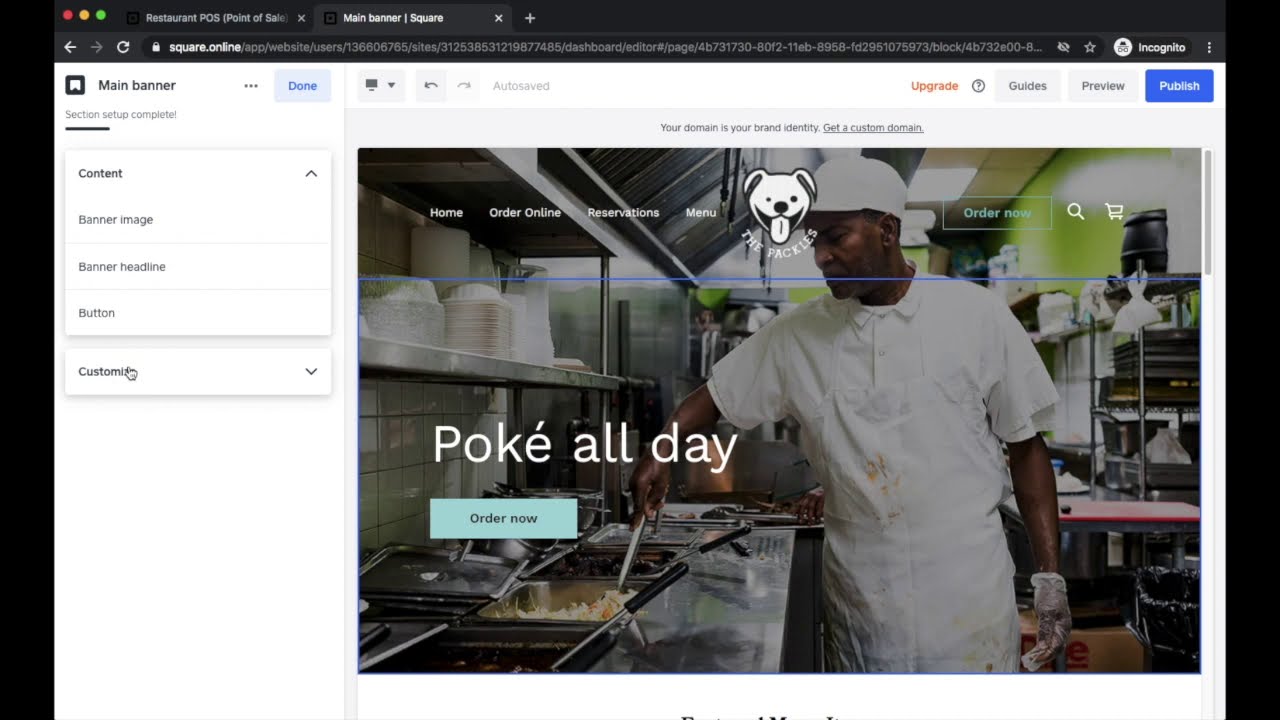

This is the first of series of videos from WHEDco/JARC to help get your business online. In this series, we will also cover:

– how to build a free retail website with eCommerce functionality

– how to build a free appointment booking website for hair/beauty/service businesses

– how to build a free menu page for restaurants

– other tips to get your business listed online.

* Weebly by Square offers a free business website, but you will be charged credit card transactions fees for items purchased through your site. For more information on fees visit: https://squareup.com/us/en/pricing

WHEDco is a nonprofit in the Bronx and a member of the Jerome Avenue Revitalization Collaborative (JARC). If you need help setting up a website for your Bronx business, email business@whedco.org[+] Show More

* Weebly by Square offers a free business website, but you will be charged credit card …transactions fees for items purchased through your site. For more information on fees visit: https://squareup.com/us/en/pricing

WHEDco is a nonprofit in the Bronx and a member of the Jerome Avenue Revitalization Collaborative (JARC). If you need help setting up a website for your Bronx business, email business@whedco.org[+] Show More

* Weebly by Square offers a free business website, but you will be charged credit card transactions fees for items purchased through your site. For more information on fees visit: https://squareup.com/us/en/pricing

WHEDco is a nonprofit in the Bronx and a member of the Jerome Avenue Revitalization Collaborative (JARC). If you need help setting up a website for your Bronx business, email business@whedco.org[+] Show More

* Weebly by Square offers a free business website, but you will be charged credit …card transactions fees for items purchased through your site. For more information on fees visit: https://squareup.com/us/en/pricing

WHEDco is a nonprofit in the Bronx and a member of the Jerome Avenue Revitalization Collaborative (JARC). If you need help setting up a website for your Bronx business, email business@whedco.org[+] Show More

Learn how your small business can benefit from the Paycheck Protection Program (PPP). During this panel, SBA-approved lenders, technical service providers, and legal representatives …answer questions on applying, eligibility, forgiveness, financial management, and more to make the most of this funding!

Where to get help with your PPP Loan:

For information: nyc.gov/ppp

Register for SoBro’s PPP webinars (Mondays): bit.ly/BxPPP

Pre-apply for PPP

– bit.ly/SoBroCARES

– spring.bank/ppp-applicants

– bit.ly/BOCPPP

Apply for legal, financial, or marketing at bit.ly/sstbapp

Moderator:

Lisa Sorin, President, Bronx Chamber of Commerce

http://www.bronxchamber.org/

Panelists:

Stephanie Charles, Cleary Gottlieb Fellow, Start Small Think Big

http://www.startsmallthinkbig.org

Pedro Estevez, President, United Auto Merchants Association

http://www.uamanys.org

John Frias, Minority Business Program Manager, BOC Network

http://www.boccapital.org

Xavier Givens, Business Developer Officer, Spring Bank

http://www.spring.bank

Christophe Le-Gorju, Sr. Director of Economic Development, SoBro

http://www.sobro.org

The Jerome Avenue Revitalization Collaborative (JARC) is dedicated to bringing inclusive economic growth and sustainability for local residents, employers, and workers impacted by the Jerome Avenue rezoning in the Bronx. More info: jarcbx.com[+] Show More

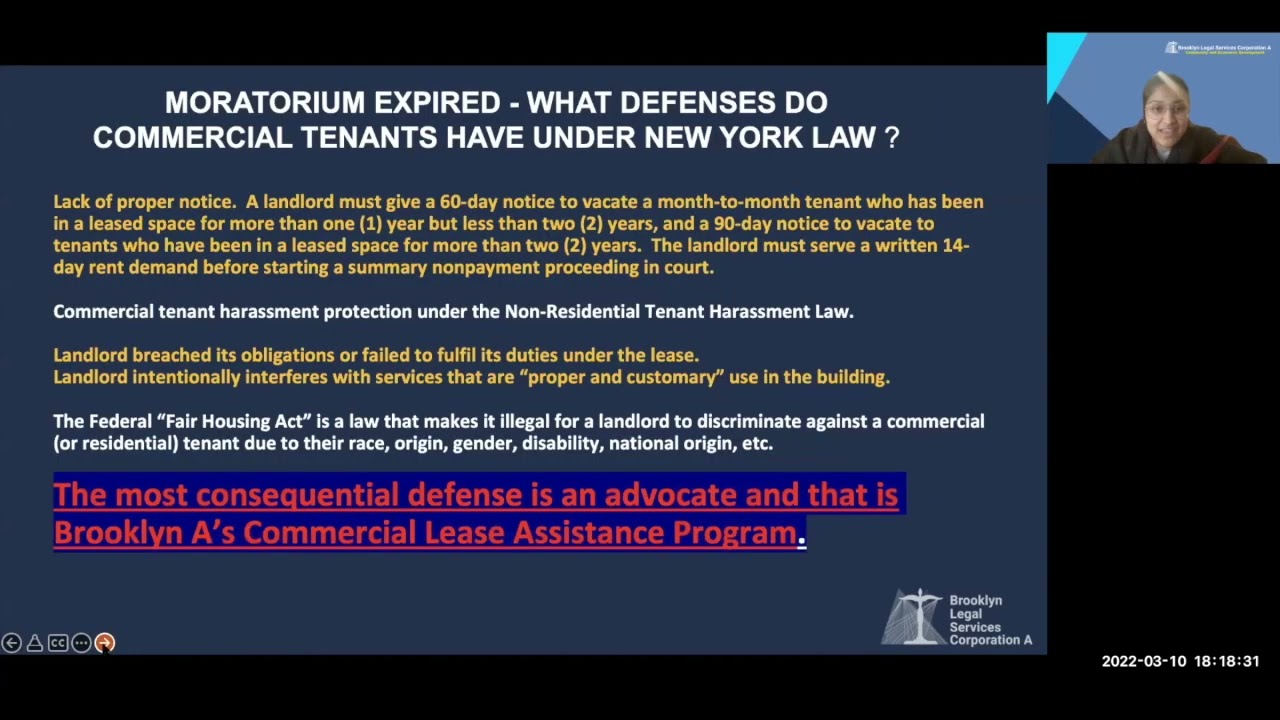

To get help from a free high-quality attorney sign up at http://www.nyc.gov/commlease or call/text WHEDco at 347-973-0945[+] Show More

– …Understand what is in your lease…

–What do you actually owe every month

–How much will your rent go up next year

–Who has to pay if repairs are needed

-Negotiate, change or end your lease

-Draft oral and unwritten agreements

-Address landlord harassment/breach of contract

…and other transactional legal services!

Call 347-973-0945 for help signing up to the CLA program![+] Show More

Articles

Evaluating Best Business Practices

In Business Resources, ResourcesUpcoming Webinar: Business Advising Roundtable

In Business Resources, ResourcesFREE BUSINESS COURSES! NYC BUSINESS SOLUTIONS BROOKLYN CENTER

In Business Resources, ResourcesTalk with a Potential Lender, Fuel Your Future!

In Business Resources, ResourcesFree November courses to help launch or grow your business

In Business Resources, ResourcesFree virtual session with a CPA

In Business Resources, ResourcesHelp improve what’s known about small businesses

In Business Resources, ResourcesRegister today for a free virtual procurement webinar

In Business Resources, ResourcesFree September courses to help launch or grow your business

In Business ResourcesJARC, WHEDco host pair of social media webinars for small business owners

In Business Resources, ResourcesCOVID-19 Capital Costs Tax Credit Program applications extended to Sept. 30

In Business Resources, ResourcesBusiness Plan Cohort II Webinar Series

In Business ResourcesYour business could win $25K: Apply for ATSB today!

In Business ResourcesProtect Your Small Business from Cyber Threats

In Business Resources, ResourcesHow the Silicon Valley Bank collapse may impact your small business

In Business Resources, Resources, Video TutorialNYC launches $75 million loan fund to help small businesses

In Business Resources, ResourcesCommercial Tennant Rights

In Business Resources, ResourcesGet Help with your Business

How to Apply for the New York City Small Business Resilience Grant

In Business Resources, ResourcesHow to Apply for the Small Business Recovery Grant from New York State

Get PPP & the RRF grant to help your business survive the COVID-19 pandemic

In Business Resources, Resources, Video TutorialGet Your Business Online (Pt. 1)

Paycheck Protection Program (PPP) Panel